IMPORTANT: The information below is general and is not intended to be legal or financial advice. Please ensure that you are legally protected by discussing your personal circumstances with a lawyer or lender who fully understands your liabilities and needs.

Finding a house you love is the first step in buying a property. Of course, a building inspection is best before an offer is made, but if you can’t risk losing the house of your dreams, you may already have an offer accepted pending building inspection and perhaps finance.

Insurance is usually placed on a house and is, in fact, often mandatory once the offer is accepted but not always necessary before a building inspection. Once you have signed the document of an offer, you must have insurance on the property yourself from 5pm on the next business day after you sign the contract of the offer. So if you sign it Monday, you must have insurance on the property by 5pm Tuesday. You may be asked to supply a Certificate of Currency to prove you have insured the property.

What is a Certificate of Currency, and why do I need it?

A Certificate of Currency is issued to prove that you have a current insurance policy on your house which is valid and current at the date of issue. These can be obtained from the Queensland Government Insurance Fund.

What should be included in a Certificate of Currency?

- The name of the owners or the insured person or party.

- The address of the insured property.

- The policy number and when the policy expires.

- The period of protection, e.g., 12 months, six months.

- The name of the lender as an interested party.

- At a minimum, the dollar amount of the insurance is the amount the lender requires.

- How much the premium is (and monthly payments if you choose to pay it this way).

Generally, insurance for a property should cover the usual general risks such as fire, moisture damage, accidental damage, and deliberate damage from others, for example, deliberate damage to gain access or accidental damage by children or contractors. However, depending on the house’s location, you may need flood or bushfire protection which is usually offered and discussed with the insurance and possibly the building inspector.

NEW TO THE PROPERTY MARKET? CHECK OUT OUR

FIRST HOME BUYERS GUIDE

What other forms do I need to be aware of when buying a home in Queensland?

When purchasing a home in Queensland, there is a general process to follow with paperwork which will include your obligation to gain insurance and prove this with a Certificate of Currency.

- The first paperwork you will encounter is the contract of sale or offer. This can be prepared by a solicitor, conveyancer, or settlement agent. Make sure you seek your legal advice on this document before signing.

- In this document, you specify if you want certain conditions such as a building inspection, finance approval date, and settlement date.

- Second, you must ensure the property by 5pm the next business day after signing the Contract of Sale or Offer, and you may be required to provide a Certificate of Currency.

- Declaration forms for Transfer of Stamp Duty are the third form you will see. Stamp Duty is usually paid on the date of settlement, but it can vary.

- Loan offer documents can follow shortly after if your conditions are met, and the building inspection does not raise any red flags.

- On settlement day, your legal representative should take care of the settlement, and there should be no additional forms for you to sign.

What happens if the building inspection uncovers a building with huge issues?

A professional building inspection can identify current problems or issues that are highly probable to cause future damage or substantial repair bills. As long as you have a building inspection as part of your offer conditions, you can either pull out of the offer or negotiate with the seller on price or repairs before the settlement date. This should be done in conjunction with a legal professional.

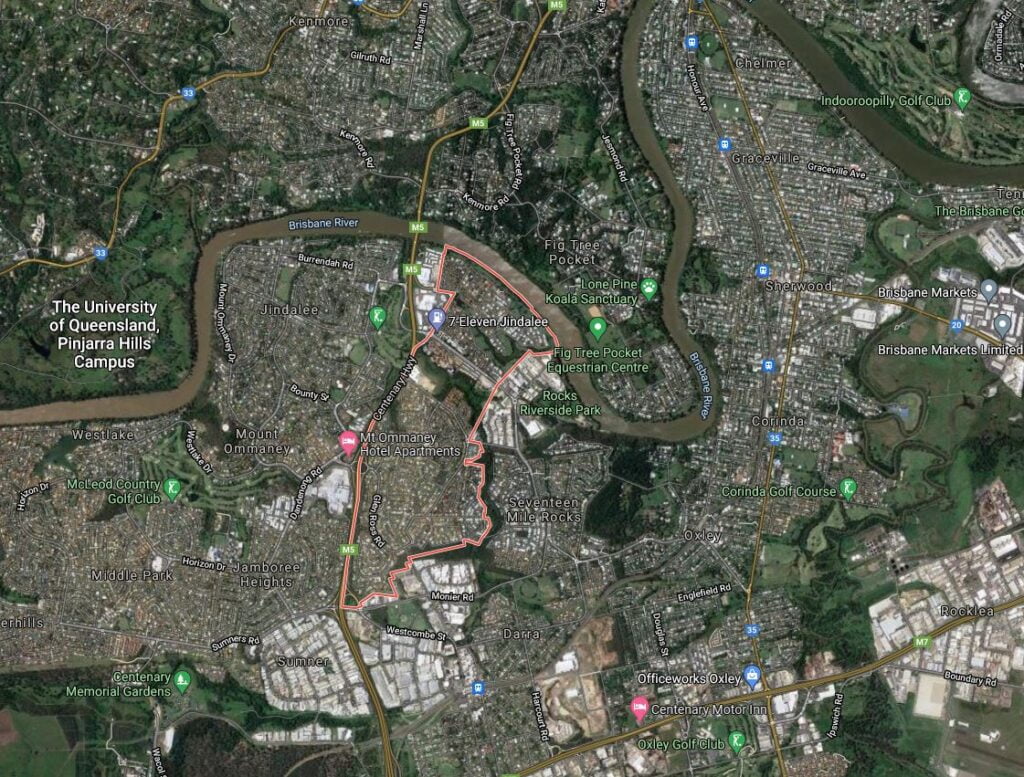

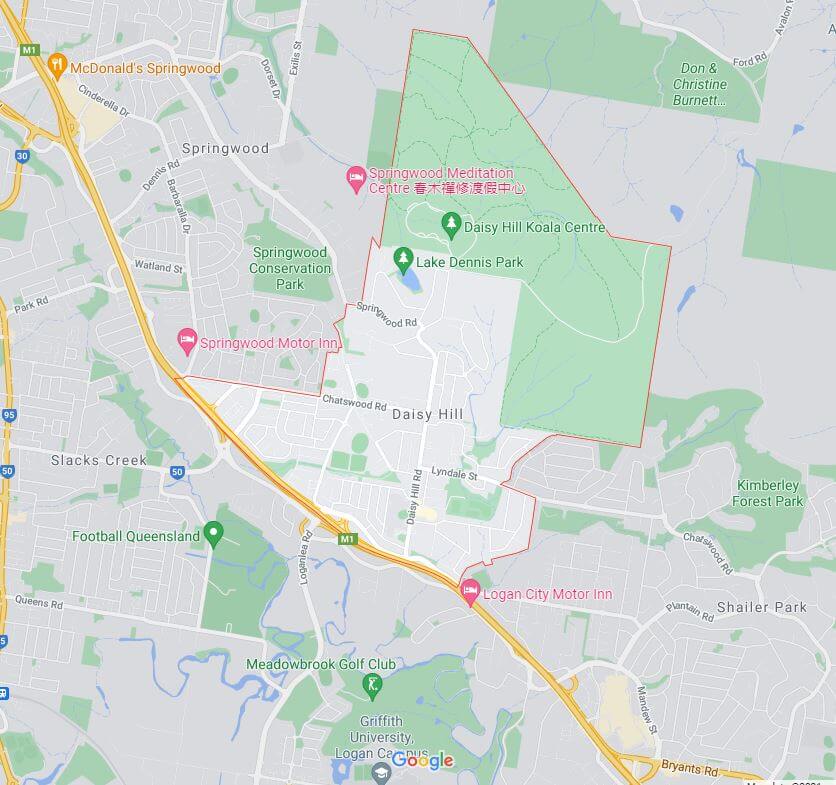

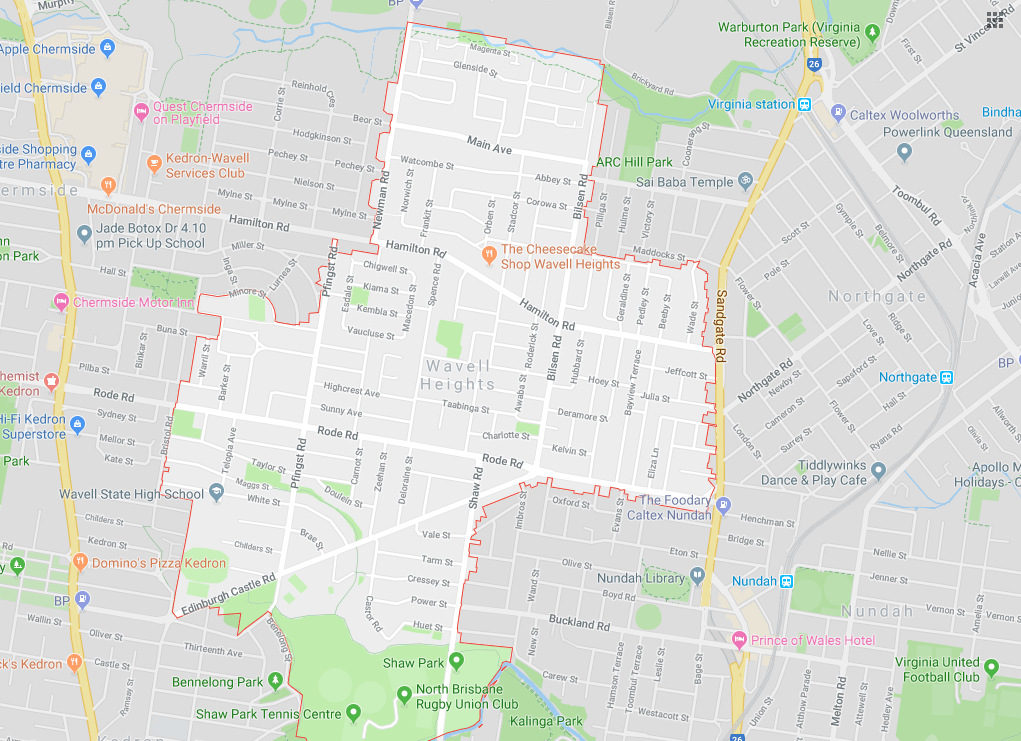

With over 25 years of experience in the Brisbane area and over 500 five-star reviews, Andrew, Action Property Inspections’ exceptionally detail-driven professional building inspector has your investment interests at heart. We’ll complete an inspection that gives you peace of mind that the house you have fallen in love with is a dream and not a future nightmare.

Contact Action Property Inspections for your property inspection needs

and take one more task off your plate.